If you are a watch lover who wants to have a high-quality replica watch but don't want to spend too much money,

www.watchesreplica.to will be your best choice.

There are several different types of Medicare Advantage plans. HMO (Health Maintenance Organizations) HMOs account for the largest share (64%) of Medicare Advantage enrollment and have been available under Medicare for several years. HMOs are the most tightly managed plans and utilize a defined network of providers that beneficiaries generally must use to receive care (with some exceptions, such as emergency care). If you get health care outside the plan’s network, you may have to pay the full cost. Do I need to choose a primary care doctor? In most cases, yes. Do I have to get a referral to see a specialist? In most cases, you need a referral. Certain services, like yearly screening mammograms, don’t require a referral. PPO (Preferred Provider Organizations) PPOs also utilize provider networks. However, with PPOs, patients can choose to obtain care outside the network for a higher cost-share amount. Do you need to choose a primary care doctor? No. Do you have to get a referral to see a specialist? No. If you see a Plan specialists cost will usually be lower. PFFS (Private Fee-for-Service Plans) PFFS plans are more flexible than HMOs and PPOs because they are not required to establish provider networks. Patients can see “any willing Medicare-approved provider” if the provider accepts the plan’s terms and conditions. However, some PFFS Plans now have a network. You can also choose an out-of-network doctor, hospital, or other provider, who accepts the plan’s terms, but you may pay more. Do I need to choose a primary care doctor? No. Do I have to get a referral to see a specialist? No. MSA... read more

The Difference Between MA and MAPD Plans Most (but not all) Medicare Advantage plans include prescription drug coverage. Plans that combine medical coverage AND prescription drug coverage are called Medicare Advantage Prescription Drug (MAPD) plans. It is important to understand the difference between MA-only and MAPD plans. MA-only plans Replace Original Medicare Administered by private insurance companies approved by Medicare Offer medical coverage only (do not cover prescription medications) Patients can add prescription drug coverage by enrolling in a stand-alone prescription drug plan (PDP) MAPD plans Replace Original Medicare Administered by private insurance companies approved by Medicare Offer combined medical and prescription drug coverage in one comprehensive... read more

Welcome to Medicare & You 2017. Since the health care law was passed more than 6 years ago, we’ve seen a transformation in this nation’s health care. We’ve covered 20 million more Americans, while providing higher-quality care at reduced costs. And now, the Quality Payment Program, the result of a bipartisan bill passed last year, builds on these improvements. This program helps make sure Medicare doctors are rewarded for providing improved care to you, instead of being paid based on the number of services they... read more

With the open registration season for Medicare plans having started on the 15th of October, the time to choose a new 2016 Medicare Advantage or Medicare Part D plan is now. The registration is only open until the 7th of December, so time is most certainly of the essence. To help you make the best healthcare choices possible, here are five tips that will make your experience much easier. 1.) Get to know the MedicareHelp.org’s website Medicare.gov is a powerful tool, and it can help you find the best deals for your particular medical needs. However, it can also be very confusing, with a host of different buttons, options, and menus. Medicare Help’s platform keeps it simple, where you can see all your available plans and your costs on one screen. And we provide the same information that Medicare.gov offers. MedicareHelp.org could be useful in your search for the cheapest healthcare. 2.) Know your drugs There are many factors that could affect your payment with regard to your drugs. Their dosages, particular restrictions surrounding them (such as requiring prior authorization or step-up therapy), co-payments (flat payments that could drastically increase the cost of your plan), or a myriad of other factors could all change your plan. Make sure you know everything about your drug(s) before attempting to choose a 2022 Medicare Part D plan. The different combinations of drugs, dosages, pharmacies, regions, and more all affect the cost outcome. Finding the right 2023 Medicare Advantage or Part D plan for you personal health combination accurately could save you hundreds of dollars. 3.) Look at the quality ratings Each plan has a unique rating,... read more

We’re excited that 2015 marked the 50th anniversary of President Lyndon B. Johnson signing into law the Medicare program. Medicare has been protecting the health and well-being of American families and saving lives for five decades. Over the years, Medicare has grown and today provides quality health coverage for more than 50 million Americans. But we’re not stopping there. Every day, we’re working to make Medicare even stronger to offer you better care and to keep you healthy. Having Medicare provides peace of mind, but it’s also important that you’re getting the most out of your coverage. Use this handbook as a resource to help... read more

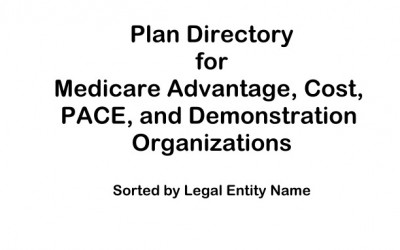

This directory contains information for Medicare Advantage, demonstration, PACE, and cost organizations that have an active contract with CMS at the time of the directory’s publication. These data have been extracted from the Health Plan Management System (HPMS), maintained by the Center for Drug and Health Plan Choice/Medicare Drug Benefit and C & D Data Group/Division of Plan Data (CPC/MDBG/DPD). This directory will be updated on a monthly basis. The plan directory contact data is maintained by each organization in HPMS. If an organization needs to update its contact data, the plan user should use the following navigation path in HPMS: HPMS Homepage > Contract Management > Contract Management > Select a Contract Number > Contact Data > Plan Directory Contact for Public Website. The enrollment number displayed in this directory has been pulled from the “Monthly Enrollment by Contract” file posted on the CMS public website. This enrollment number represents the number of enrollees for which the contract received payment for the month. As asterisk in place of the enrollment number indicates that the count is less than 10. Pilot contracts are excluded from this... read more

All types of insurance are complicated to figure out, and Medicare is no less so. There are certain things that may be useful to know if you are thinking of applying for Medicare next year, or if you would like to make changes from an already existing plan. Medicare plans are often altered, with the costs, coverage, pharmacies and providers changing almost constantly. Therefore, this is the period where you can re-evaluate whether a particular plan is good for you or not. Open Enrollment Period From the 15th of October to the 7th of December the Medicare Open Enrollment Period will be running. It runs at the end of every year. During this time you can make changes to your Medicare plan, or, if you do not already have a plan, you can sign up for Medicare. Usually, information for next year’s plans is released in October, giving you time to decide whether you would prefer a switch or not. If you apply for Medicare in this period you will be covered from the first of January next year. During the Open Enrollment Period you can: Change your plan from an Original Medicare plan to a 2023 Advantage plans, or vice versa. Get drug coverage by signing up for a 2022 Part D plan. Get a new Part D plan if you are unhappy with the one you have now, or if circumstances have changed and you need to make adjustments in your plan. Definitions of Key Terms Original Medicare: Original Medicare is a health insurance program funded and managed by the federal government. If you are eligible and you get Medicare... read more

About 6 to 12 months before most Americans turn 65, they are bombarded with junk mail offers for different Medicare-related insurance products such as Medicare supplements, Part D prescription drug plans, Medicare Advantage plans, annuities, and life insurance policies. It is no wonder that most consumers that are Medicare eligible are confused about the choices. It almost seems like some companies want you to feel that way. In this article, we will explain in layman’s terms exactly what a Medicare Advantage plan is, how it works, what they usually cost, and then, you can decide for yourself if they are right for you. What is the difference between a Medicare Supplement and Medicare Advantage Plan? • A Medicare supplemental insurance policy is a standalone health insurance policy that is purchased by seniors to cover some of the costs not picked up by traditional Medicare, the most significant cost being the 20% of Part B expenses not covered by Medicare. Also referred to as a Medigap policy, one of the most popular benefits is that you can use this kind of policy with any Medicare provider. You do not have to worry about networks or unexpected out-of-pocket costs. If you need prescription drug coverage, you would need to pick up a separate Part D drug plan, since Medigap policies do not cover outpatient prescription drugs. • A Medicare advantage plan also referred to as Part C, is a health plan that includes outpatient prescription drug coverage, also called Part D. Advantage plans have special times during the year when you can sign up called “Enrollment Periods.” If you fail to... read more

Humana and Walmart teamed up back in 2010 to offer one of the most price competitive drug plans in the history of the Part-D drug program, and they have been going strong ever since. One of the reasons why their partnership is so successful is using a Walmart or Sam’s Club pharmacy to fill your prescriptions will get you the lowest cost possible for your prescription drugs versus going to any other pharmacy. Another reason for the success of the program is the four dollar generic prescription drug program that they have been pioneering for the last several years. Last but certainly not least, the cost of the drug plan is so low that pretty much any senior looking for a drug card can afford it, especially if they are only taking generic or low-cost brand drugs. For 2015, the premium for the Humana Walmart RX plan is only $15.60 per month, with a co-pay as low as one dollar after the deductible is met if you fill your prescription at Walmart-branded pharmacies. What’s amazing is that some drugs can come at absolutely no cost to the consumer if they use mail order, after the deductible is met. The plan covers over 1,500 generic prescription drugs, which happens to be quite more than some of their competitors. The deductible this year for this drug card is $320, and this is for all tiers of drugs. It includes your tier 1 cheap generic medications as... read more

Michigan seniors have been hit with the full cost of brand name drugs, thanks to new legislation. Effective this year, the law eliminated Medicare’s Part D prescription drug plans offering coverage during the gap period, dubbed the “donut hole.” People such as Janet Clapper, 72, of Battle Creek are finding out some of their brand-name drugs covered in 2006 are not covered this year. She said she reached the gap period around March or April and has had to dip into her savings for the about $700 a month cost of her multiple prescriptions. “I saved my money because I knew I’d need it when I got old, but now the government’s taken it all,” she said. Seniors eligible for Medicare in 2006 selected from a list of competitive Part D plans offered by private insurance companies to cover the cost of prescriptions. The sign-up period generally is Nov. 15 to Dec. 31 for coverage without penalty beginning the following year. But many seniors were shocked last year to discover coverage stopped when the total cost reached $2,251. Most seniors taking expensive, brand-name drugs ended up paying thousands of dollars out-of-pocket for prescriptions mid-year. The donut-hole coverage gap lasted until the total cost hit $5,100; then emergency coverage kicked in, bringing the cost down to just a few dollars for each drug. Some plans in 2006 offered coverage during the donut hole for a higher premium cost. This year, that’s not even an option. “Regardless of anything, I would have had to pay full price for all them drugs,” Clapper said. “That was the new law.” In Michigan, there... read more

Site Search:

MedicareHelp.org is a privately-owned Non-governmental agency. The government website can be found at HealthCare.gov.

Please contact Medicare.gov, 1-800-MEDICARE, or your local State Health Insurance Program (SHIP) to get information on all of your options. Enrollment depends on the plan’s contract renewal.

Every year, Medicare evaluates plans based on a 5-star rating system.